As we head into the holidays and mark the final stretch of the year, I wanted to report on the 2024 real estate market and where we might be headed in 2025. To set the stage, I must mention the ride that it has been over the last five years. Since 2019, we have experienced some key market factors that have influenced market activity and prices.

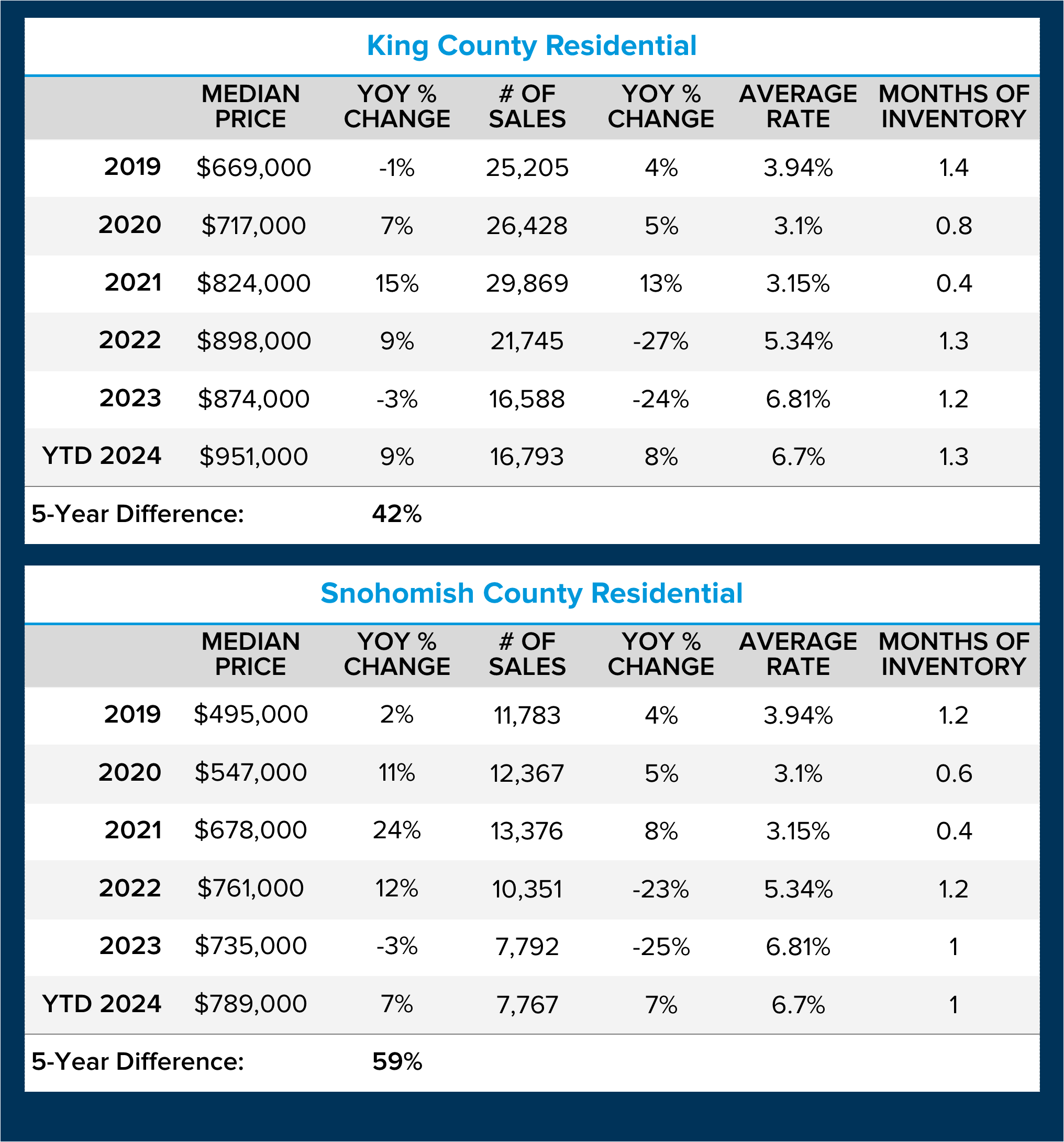

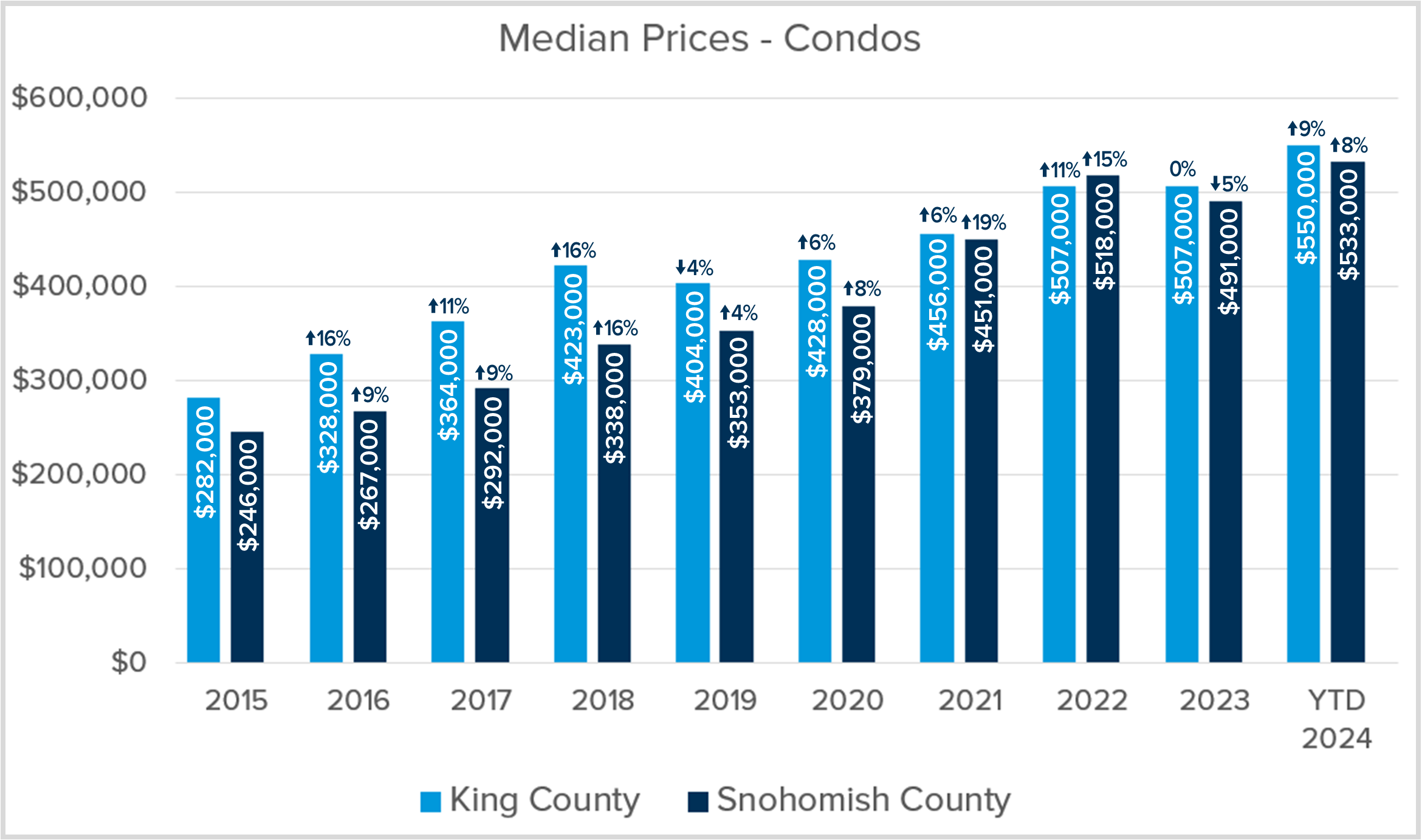

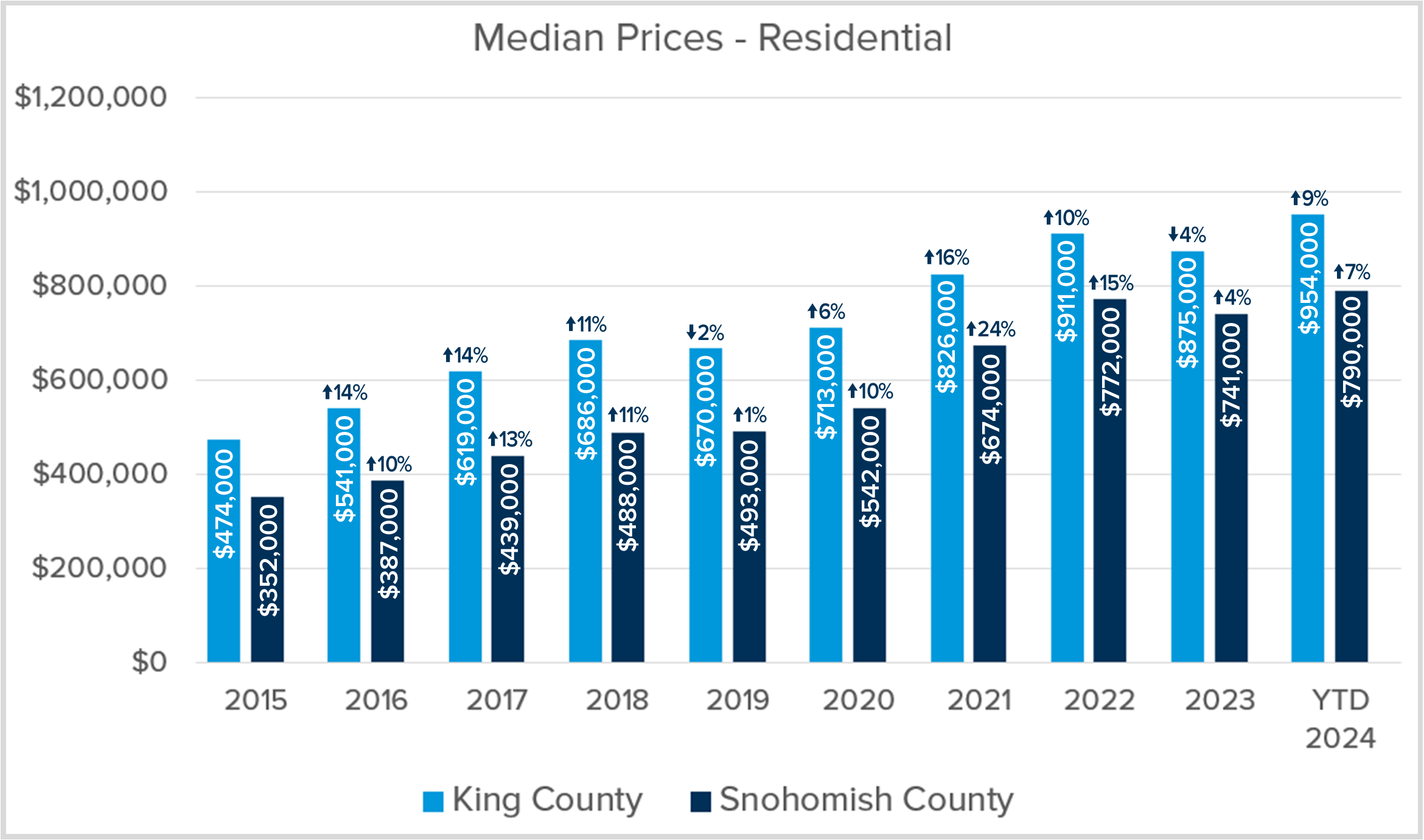

2019 was a year of recovery after the market corrected in 2018 (due to the Seattle Head Tax), and we all know what happened in 2020. The pandemic threw the real estate market into a frothy uptick from mid-2020 to mid-2022, fueled by work-from-home moves and historically low interest rates. Sales counts and price appreciation were ” off the charts,” specifically in 2021. Once interest rates climbed over 5% in the spring of 2022, price appreciation capped, started to correct, and sales declined. Since then, prices have recovered and stabilized, and the sales count has slowly started to increase.

After reviewing the last 10 years of closed sales, we are down about 25% YTD in King County and 30% in Snohomish County from a normal average closed sales rate. This has remained stubborn due to the lock-in effect that the previous low rates have created. For example, many homeowners who purchased or re-financed to obtain a rate of 3-4% are holding tight to their monthly payments. This has caused many people to stay in homes that don’t ideally fit their lifestyle due to wanting to keep the monthly payment and overall affordability.

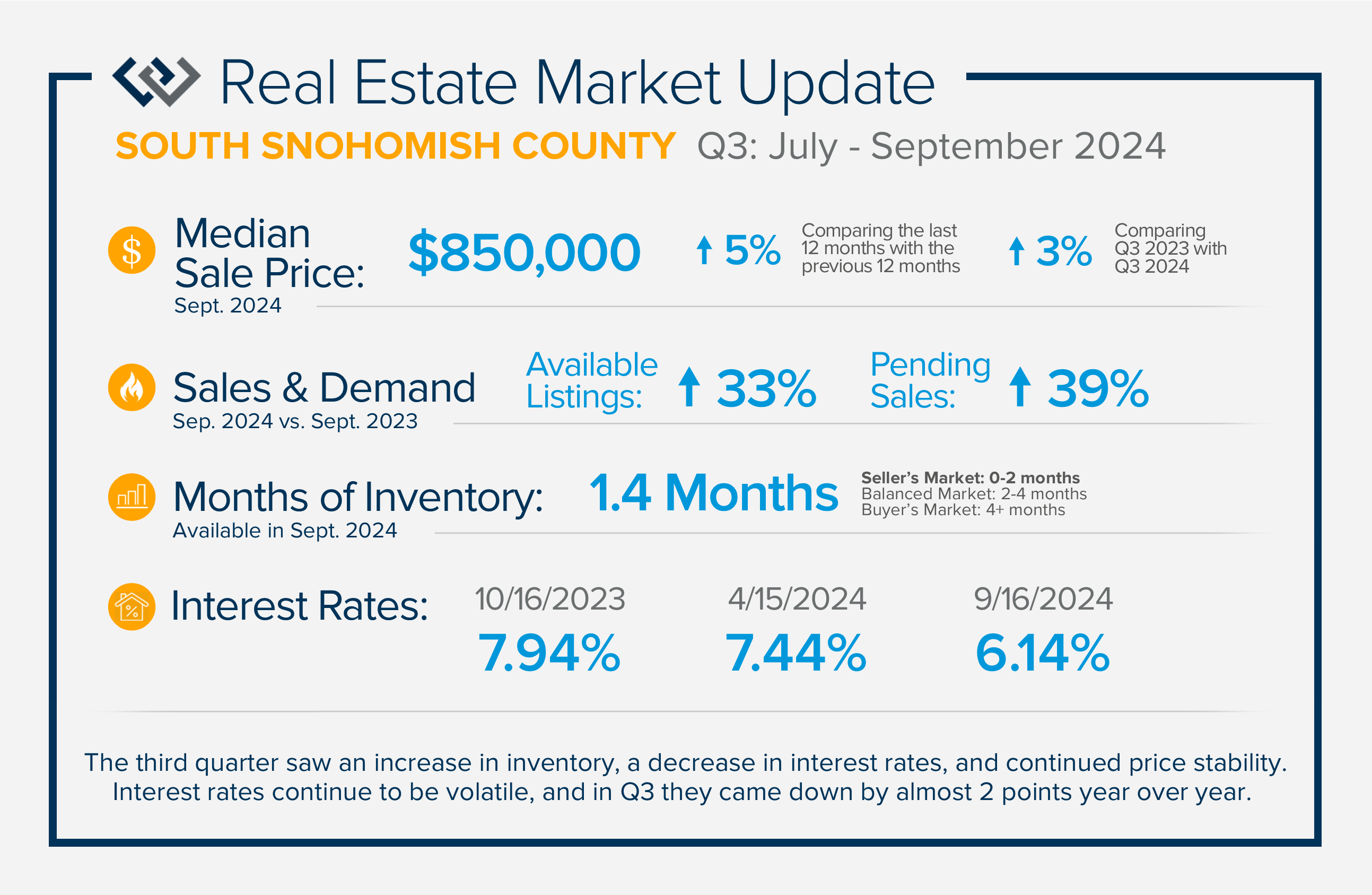

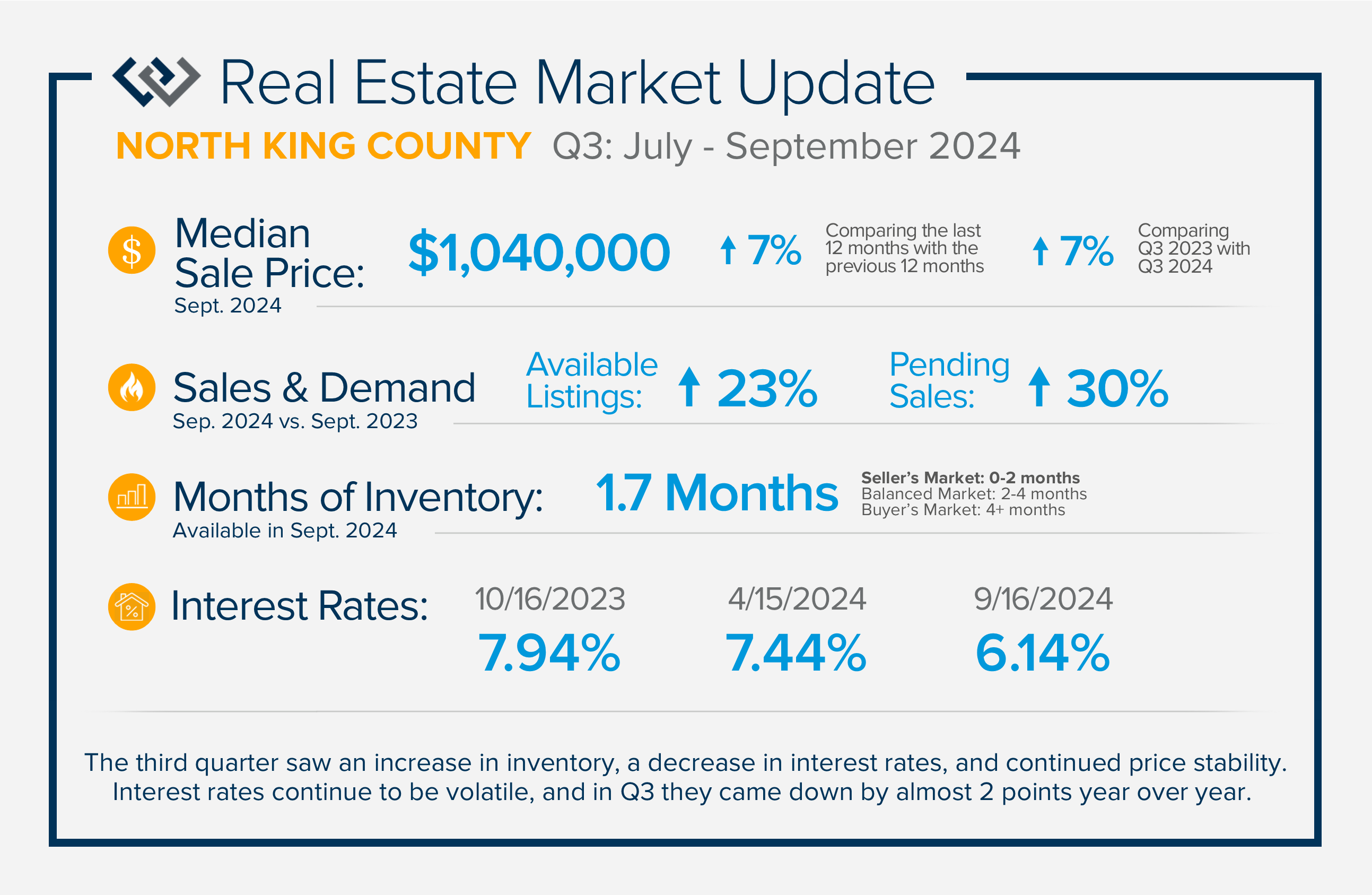

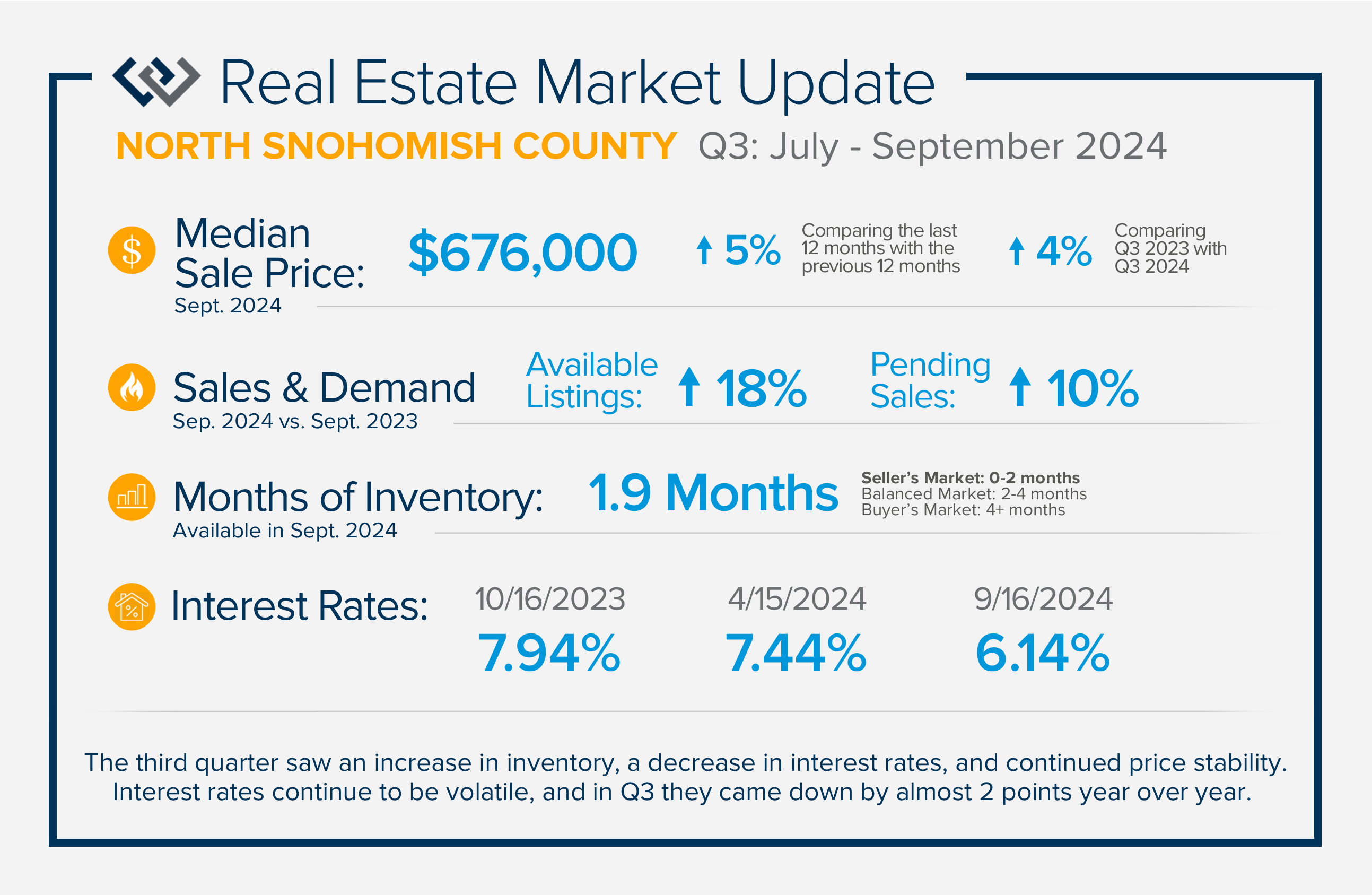

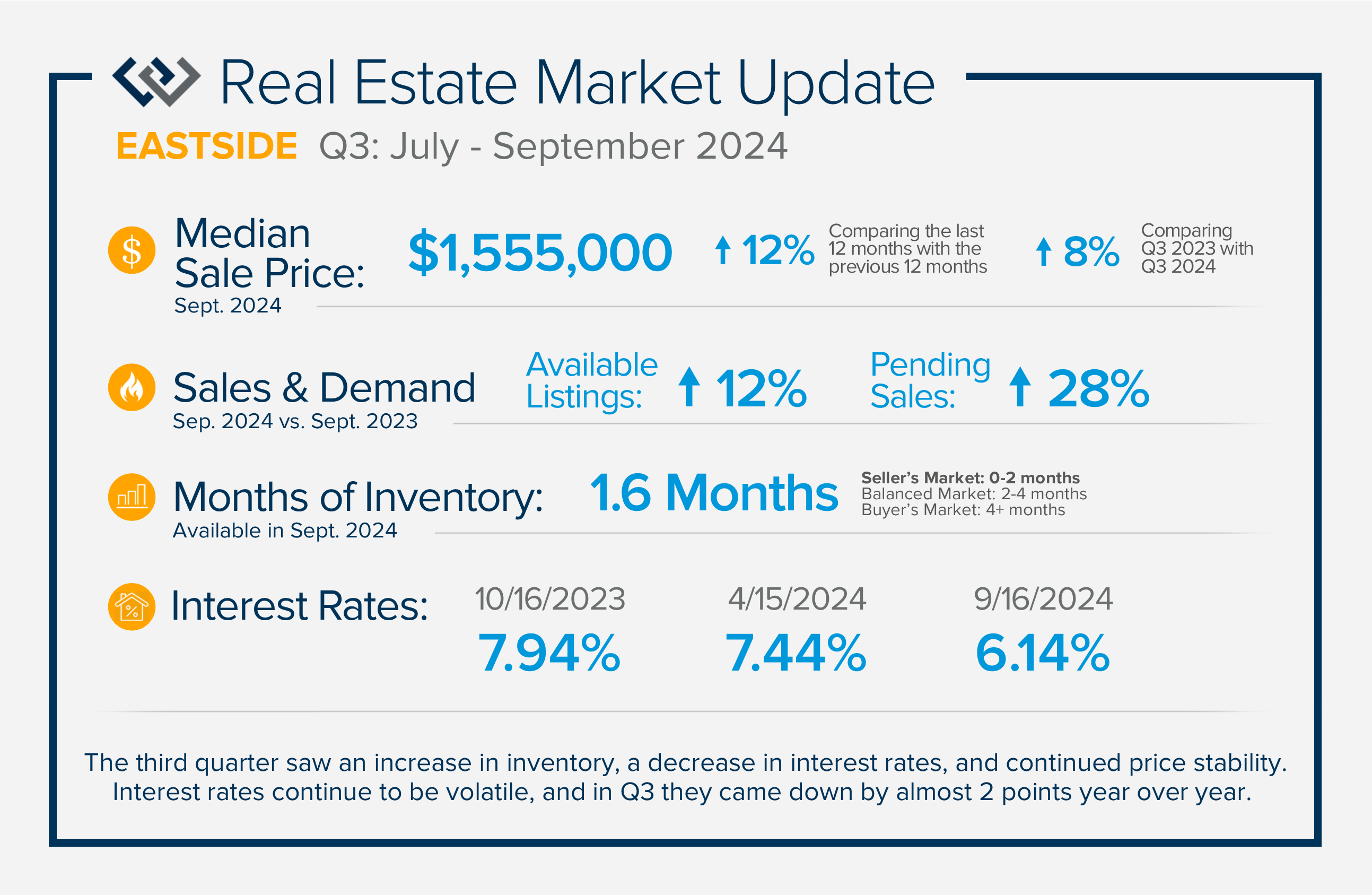

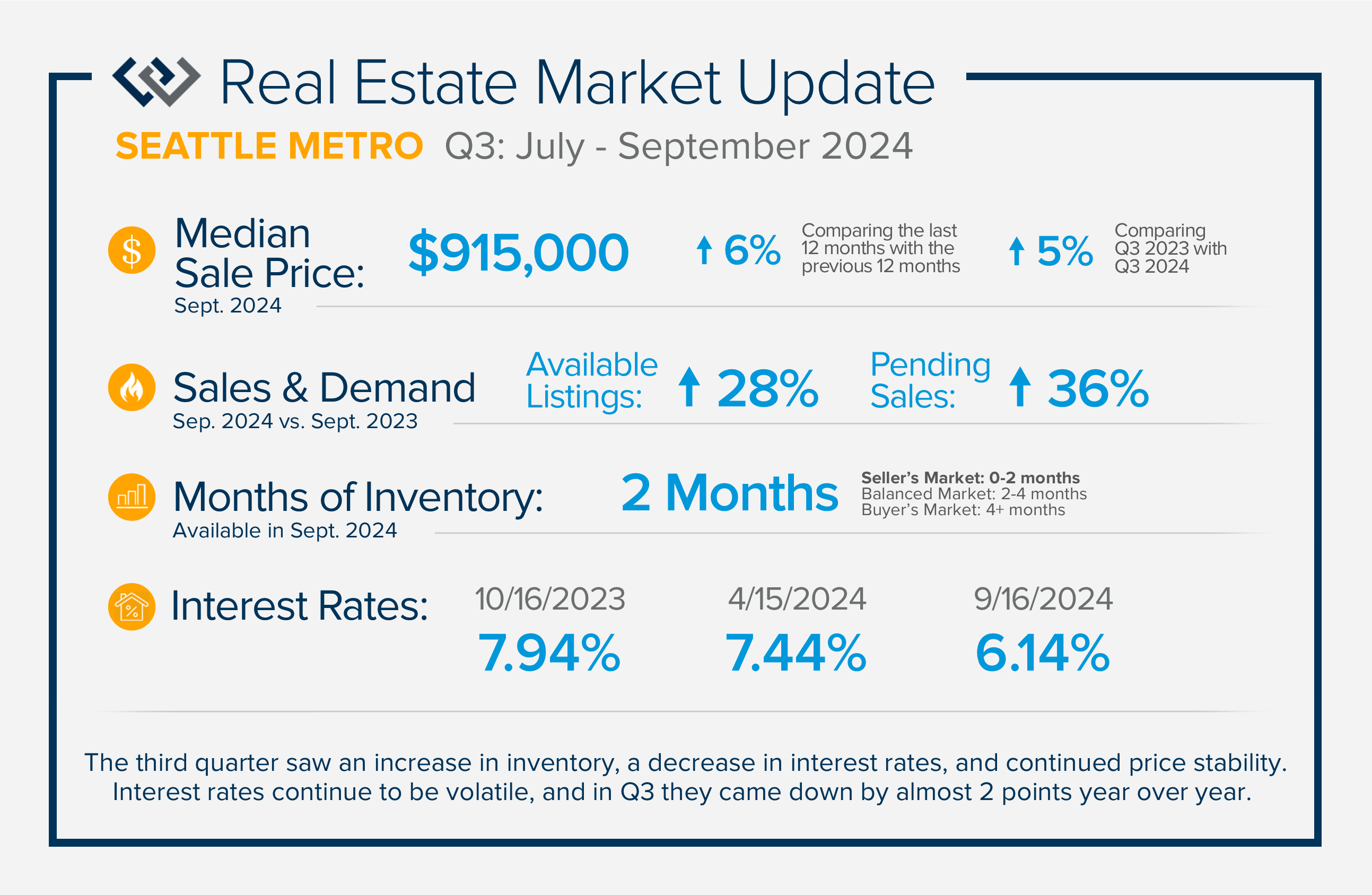

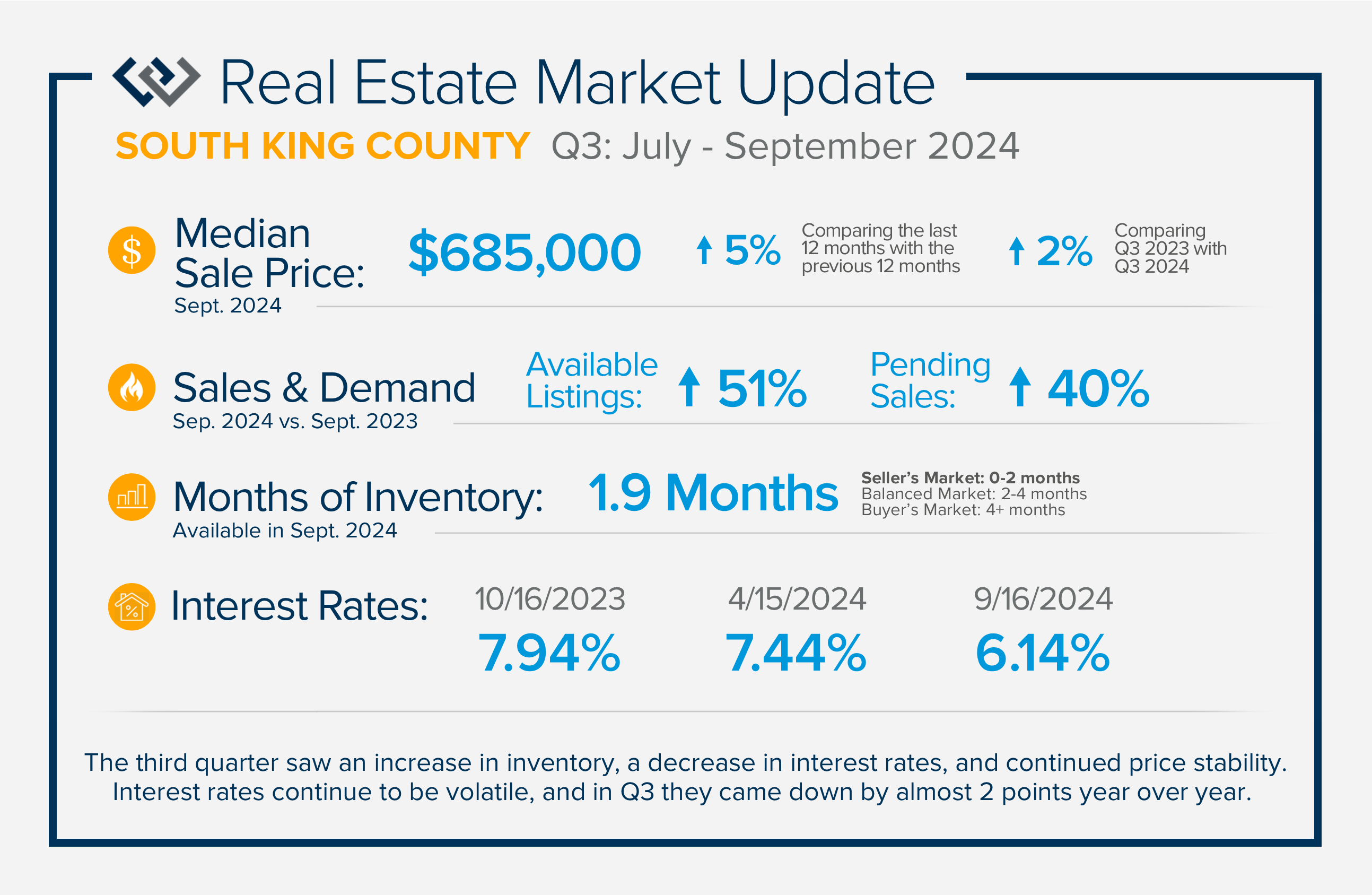

This has created tight inventory, which has insulated prices and helped the market recover from the 2022 correction. The dance between rates and low inventory is directly related, and despite rates being higher in 2024 than they were in 2022, prices remain strong. A seller’s market is defined by 0-2 months of inventory (if no new homes came to market, we would sell out of homes in this amount of time), a balanced market is 2-4 months, and a buyer’s market is 4+ months. Over the last 5 years, we have primarily been in a seller’s market. This has caused prices to increase by 59% in Snohomish County over the last 5 years and by 42% in King County.

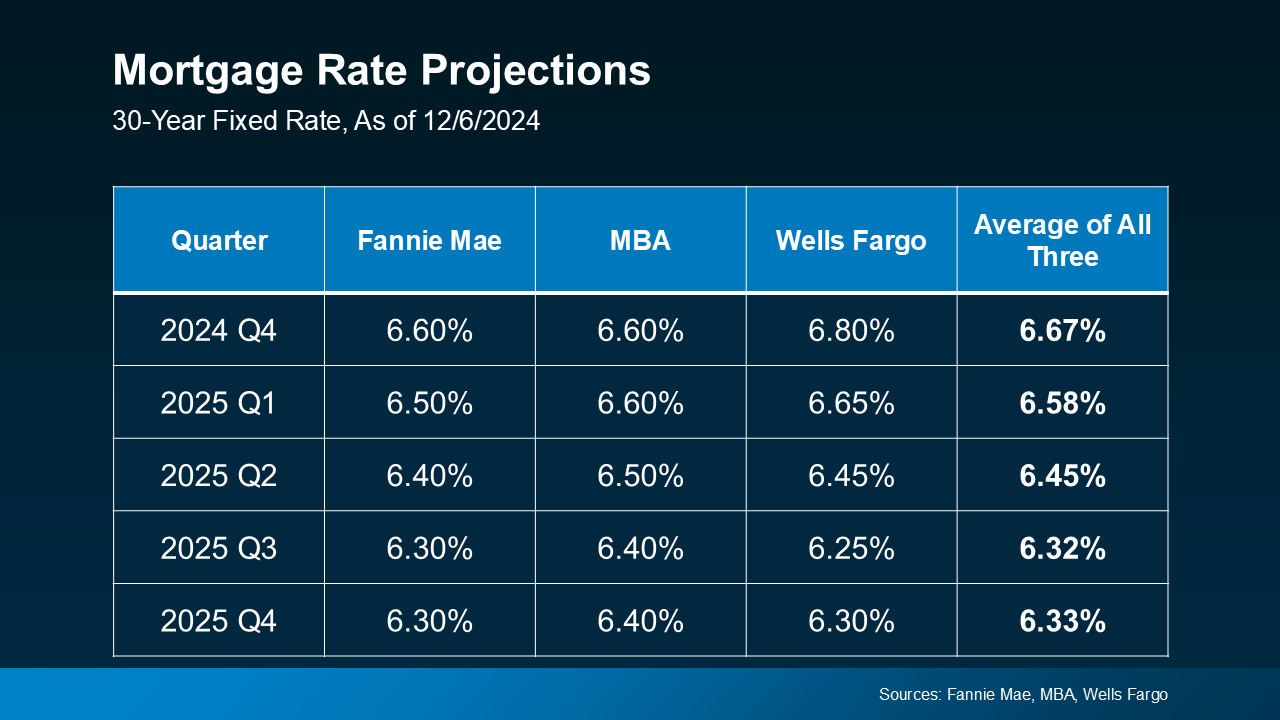

The age-old principle of supply and demand has had the most significant impact on prices despite volatile interest rates. Several experts predict that interest rates will slowly decrease throughout 2025. As you can see from the chart below, we will not return to the historic levels we saw in 2020-2021 (we may never). As would-be sellers contemplate the lock-in effect vs. what they want/need out of their housing and line it up against interest rates, we should see a gradual increase in closed sales in 2025 over 2024. The market is slowly starting to accept this new normal. Also, in some cases, moves cannot be delayed due to life circumstances, and the lock-in effect is not a driver.

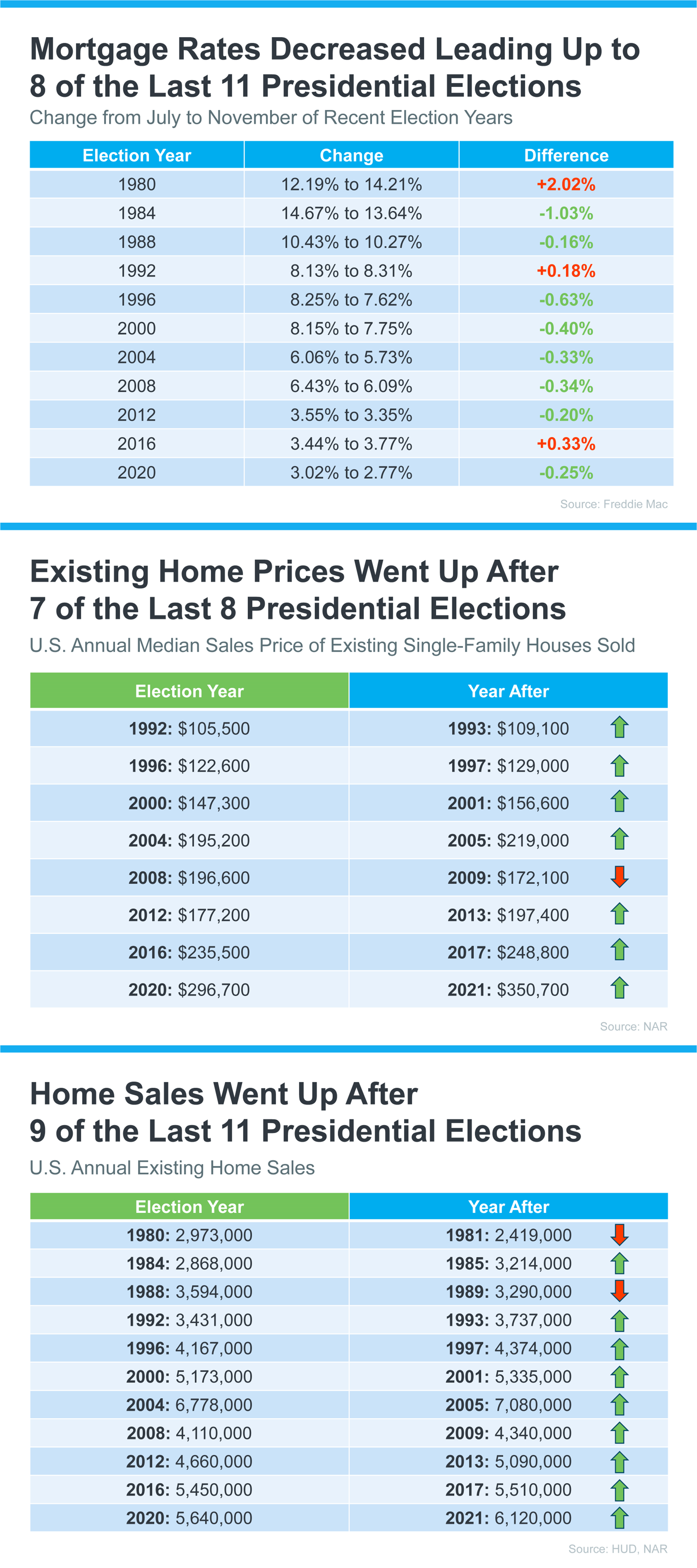

Another aspect to point out is the trends we typically see in post-election years. Historical data indicates increased closed sales, lower interest rates, and price growth. This data, coupled with pent-up seller demand and gradually decreasing interest rates, should drive sales to increase slightly and prices to appreciate and remain stable. Most homeowners are sitting on well-established equity, enabling them to make fluid moves.

If you or someone you know is considering buying, selling, or both, now is a great time to reach out. Executing a purchase and/or sale and a move takes strategic planning to achieve the best outcome. I love helping my clients identify their goals, curate a detailed list of items to create the ideal results, and help guide the process to a successful finish. A new year brings a fresh start, and why not start to verbalize, visualize, and start your planning now, whether your goals are immediate or in the distant future? Please use me as your real estate resource, as my goal is to be your trusted advisor rooted in data and market education.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link